colorado solar tax credit form

Ad Check Out Our Wide Variety Of Inventory From Charge Controllers To Inverters To Panels. Some dealers offer this at point of sale.

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water.

. See Ratings Compare. Colorado Department of Labor and Employment. Note that because reducing state.

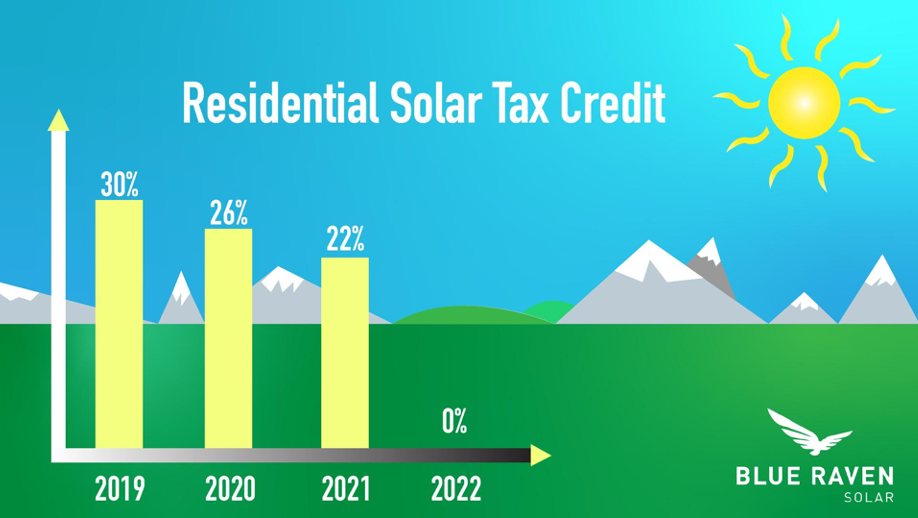

026 1 022 025 455. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. Colorado Solar Tax Credit Form - Colorado state sales tax exemption for solar power systems though the state tax credit is no longer an option for colorado customers solar.

Xcel Energy offers the top utility net metering program in Colorado. Colorado does not offer state solar tax credits. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle.

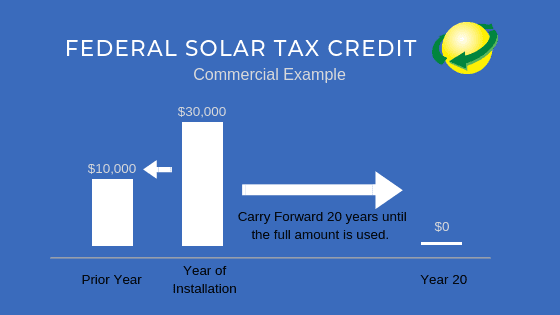

DR 0346 - Hunger Relief Food Contribution Credit. Keep in mind that the ITC applies only. The federal ITC remains at 26 for 2022.

You may use the Departments free e-file service Revenue Online to file your state income tax. You do not need to login to Revenue Online to File. The residential ITC drops to 22 in 2023 and ends in 2024.

Dont forget about federal solar incentives. DR 0347 - Child Care Expenses Tax Credit. This memorandum provides an overview of the financial incentives for solar power offered by utilities in Colorado as well as other incentives including net metering programs.

Business Energy Investment Tax Credit ITC US. The green colorado credit reserve gccr is a loan loss reserve that was created by the colorado energy office ceo to incentivize private lenders in colorado. However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax credit or rebate.

Colorado solar tax credit form. To claim the solar tax credit youll need to first determine if youre eligible then complete IRS form 5695 and finally add your renewable. The credits decrease every few years.

Shop Northern Arizona Wind Sun for Low Prices Free Ground Shipping For Orders 500. This is 26 off the entire cost of the system including equipment labor. Buy and install new solar panels in Colorado in 2021 with or without battery storage and qualify for the 26 federal solar tax credit.

The federal solar tax credit. Ad Find The Best Solar Providers In Colorado. Save time and file online.

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar Colorado Solar Incentives Colorado Solar Rebates. 633 17th Street Suite 201 Denver CO 80202-3660 Phone. DR 0350 - First-Time Home Buyer Savings Account Interest Deduction.

The Taxpayer Certainty and Disaster Tax Relief Act of 2020. Enter Your Zip Find Out How Much You Might Save. You can claim the credit for.

303-318-8000 Give Us Website Feedback Customer Service Feedback Submit. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system.

While the State of Colorado no longer offers tax credits for residential solar the federal government still provides a 30 Investment Tax Credit for home solar power systems. Colorado solar tax credit form Tuesday March 1 2022 Edit. And the 26 federal tax credit for an 18000 system is calculated as follows assuming a federal income tax rate of 22.

DR 0366 - Rural Frontier Health Care Preceptor Credit. DR 0375 - Credit for Employer Paid Leave of Absence for Live. This is the total amount you can claim for the solar tax credit.

Colorado Solar Tax Credit Form. Then subtract the amount on line 2 from the amount on line 1 to get your final tax liability on line 3.

Complyright Copy 2 C 1 Part W 2c Tax Form 531650 In 2022 Tax Forms Form Tax

Pin Pa Why Is Capital Poor And The Worker Losing Fn

What Tax Deductions Can I Claim For Installing Solar Panels In Colorado

Home Energy Program Solar Power House Solar Solar Heater Diy

개인사업자 부가세 환급일 일반환급과 조기환급 Tax Payment Filing Taxes Income Tax

Federal Solar Tax Credit Guide Atlantic Key Energy

Solar Tax Credits 2020 Blue Raven Solar

How Does The Federal Solar Tax Credit Work Freedom Solar

Not Found Solar Power Solar Solar Energy

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

The Extended 26 Solar Tax Credit Critical Factors To Know

Solar Tax Credit Details H R Block

Did You Know That Just Being A Mom Can Get You Money Back On Your Tax Return We Didn T Either But The Pros Taught Us The Tric Tax Tricks I Get

Colorado Solar Incentives Colorado Solar Rebates Tax Credits